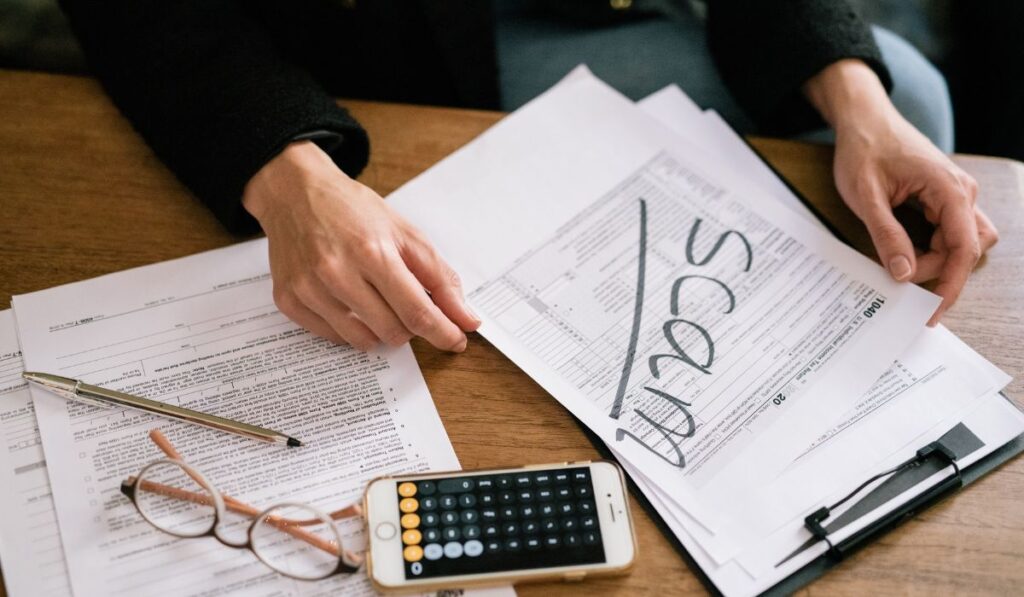

Don’t Get Tricked: How to Spot and Avoid Employment Scams

In today’s digital era, employment scams have become increasingly prevalent, targeting job seekers who are eagerly searching for opportunities. These scams can have devastating consequences, both financially and emotionally, for individuals who fall victim to them. It is crucial to raise awareness about employment scams and equip job seekers with the knowledge and tools to protect themselves.

This article aims to shed light on the issue of employment scams, providing insights into their tactics, red flags, and prevention strategies. By understanding the nature of these scams and being vigilant in their job search endeavors, individuals can significantly reduce their risk of becoming victims. Let’s explore the world of employment scams and empower job seekers to navigate the job market safely and confidently.

Table of Contents

Understanding Employment Scams

Employment scams refer to fraudulent schemes designed to deceive job seekers with false promises of employment or financial gain. Scammers exploit the vulnerability and eagerness of individuals seeking job opportunities, preying on their desire for stable employment and financial security.

These scams can take various forms, including fake job postings, work-from-home schemes, and pyramid schemes disguised as legitimate job opportunities. Scammers often use tactics such as posing as employers, recruiting agencies, or job boards to lure unsuspecting victims into their traps.

The primary objective of employment scams is financial gain for the scammers. They may seek upfront fees for job applications or training materials, request personal and financial information for identity theft, or even engage victims in money laundering activities. In some cases, scammers may use job offers as a cover for illegal activities, putting victims at risk of legal implications.

It is important for job seekers to be aware of the tactics employed by scammers and to exercise caution throughout their job search process. By understanding the nature of employment scams, individuals can better protect themselves and make informed decisions when pursuing job opportunities.

Common Types of Employment Scams

Work-From-Home Scams

These scams often promise individuals the opportunity to work remotely and earn a substantial income. Scammers may advertise jobs that require minimal effort or special skills, claiming high pay rates for easy tasks. However, victims are typically required to pay upfront fees for training materials or equipment, only to discover that the promised work or payment never materializes.

Fake Job Postings

Scammers create fraudulent job listings on reputable job boards or websites, posing as legitimate employers. These postings may appear enticing, offering high salaries and attractive benefits. However, once individuals apply for the job or proceed with the hiring process, scammers may request personal information or payment for background checks or application fees.

Pyramid Scheme Disguised as Employment Opportunities

Some scammers disguise pyramid schemes as legitimate job opportunities, promoting them as “network marketing” or “multi-level marketing” positions. They lure individuals with promises of high earnings by recruiting others to join the scheme. Victims may be required to purchase expensive products or pay membership fees, with the false promise of earning commissions from subsequent recruits.

Prepayment Scams

In this type of scam, victims are offered a job or freelance opportunity but are asked to make an initial payment or deposit. The scammers may claim it’s for training, equipment, or administrative purposes. However, once the payment is made, the scammers disappear, leaving the victim without any job or means of recovering their money.

It’s essential for job seekers to be vigilant and exercise caution when evaluating employment opportunities. Researching the company, verifying the legitimacy of the job posting, and avoiding any requests for upfront payments or personal financial information are crucial steps in avoiding employment scams.

Warning Signs and Red Flags

- Unrealistic Job Offers: Be cautious of job offers that promise extremely high salaries or benefits that seem too good to be true. Scammers often use these enticing offers to attract unsuspecting job seekers.

- Requests for Upfront Fees or Payments: Legitimate employers typically do not require applicants to pay fees for job applications, background checks, or training. Be wary of any requests for upfront payments, as they could be a sign of a scam.

- Poor Communication or Unprofessional Correspondence: Pay attention to the quality of communication from potential employers. Look for typos, grammatical errors, inconsistent font styles, or unprofessional email addresses. Legitimate companies usually have professional and consistent communication standards.

- Fake Recruiters or Hiring Managers: Scammers may impersonate recruiters or hiring managers from well-known companies. Research and verify the identity and credentials of the individuals contacting you, and cross-reference their information with official company channels.

- Fraudulent Interview Processes: Be cautious if the interview process seems unconventional or overly simple. Legitimate employers typically conduct comprehensive interviews that assess your qualifications and fit for the role. Scammers may try to rush the process or avoid in-depth discussions.

- Poor Online Presence or Inconsistent Information: Research the company offering the job and check their website, social media profiles, and online reviews. Be skeptical if the company has limited or inconsistent online presence, or if information about the company is difficult to find.

Remember, if any of these warning signs are present, it is important to exercise caution and thoroughly investigate the opportunity before proceeding. Trust your instincts and prioritize your personal and financial security.

Protecting Yourself: Best Practices

Conduct Thorough Research on Employers

Before applying for a job or providing any personal information, research the company thoroughly. Visit their official website, check their online presence, and look for reviews or feedback from previous employees. Ensure that the company is legitimate and reputable.

Verify Job Offers and Companies

Be cautious of unsolicited job offers or opportunities that seem too good to be true. Verify the legitimacy of the job offer by contacting the company directly through their official channels. Avoid using the contact information provided in suspicious emails or messages.

Be Cautious with Personal Information

Be mindful of the information you share during the job application process. Legitimate employers typically ask for relevant information such as your resume, references, and educational background. However, be cautious about providing sensitive personal information like your Social Security number or financial details unless you are confident in the legitimacy of the employer.

Use Trusted Job Search Platforms

Utilize reputable job search platforms that have security measures in place to verify job listings and protect job seekers. Stick to well-known platforms with a strong track record of vetting employers and job postings.

Trust Your Instincts

If something feels off or suspicious during the job search or application process, trust your instincts. If a job offer seems too good to be true or if the communication raises red flags, it is better to err on the side of caution and avoid further engagement.

Research Salaries and Benefits

Be familiar with the average salary range and benefits offered for the position you are applying for. If a job offer significantly deviates from the industry standards, it could be a red flag for a potential scam.

Seek Recommendations and Advice

Consult with trusted friends, family, or professionals who have experience in the industry or job market. They can provide insights, offer guidance, and help you evaluate the legitimacy of job opportunities.

By following these best practices and exercising caution, you can reduce the risk of falling victim to employment scams and protect your personal and financial information. Remember, it is crucial to prioritize your safety and well-being throughout the job search process.

Dealing with Employment Scam Attempts

- Avoid Sharing Sensitive Information. Be cautious about sharing sensitive personal information, such as your Social Security number, bank account details, or copies of your identification documents, unless you have verified the legitimacy of the employer or recruiter. Legitimate employers typically request such information after a formal job offer has been made.

- Be Wary of Financial Transactions. Exercise caution if a potential employer or recruiter asks for upfront fees or requests financial transactions as a condition of employment. Legitimate employers generally do not require job applicants to pay for job opportunities.

- Research the Company and Contact Information. Conduct thorough research on the company and verify the contact information provided by the employer or recruiter. Cross-check the company’s details with official sources and use contact information found on the company’s official website or through trusted channels.

- Trust Your Instincts. If something feels off or suspicious during the recruitment process, trust your instincts. If a job offer or interaction raises red flags, such as unprofessional communication, inconsistent information, or demands for immediate action, it’s best to proceed with caution or disengage from further communication.

- Report the Scam. If you suspect you have encountered an employment scam, report the incident to the appropriate authorities. Contact your local law enforcement agency, the Federal Trade Commission (FTC), or the appropriate fraud reporting agency in your country. Providing relevant details and any evidence you have can help in investigating and preventing further scams.

- Seek Support. If you have fallen victim to an employment scam, seek support from professionals who can assist you in dealing with the situation. Contact your local consumer protection agency, seek legal advice, and consider reaching out to organizations that specialize in supporting scam victims.

Remember, being proactive and cautious in your job search can significantly reduce the risk of falling victim to employment scams. Stay informed, trust your instincts, and prioritize your safety and security throughout the process.

Reporting Employment Scams

- Law Enforcement Agencies: If you have encountered an employment scam, it is important to report the incident to your local law enforcement agency. They can investigate the matter and take appropriate action against the scammers. Provide them with all relevant details, including any communications, emails, or documents related to the scam.

- Job Portals and Websites: If you came across a fraudulent job posting on a specific job portal or website, report the scam to the platform’s administrators. Most reputable job portals have mechanisms in place to report suspicious listings. Look for a “Report” or “Flag” button on the job posting page and provide the necessary details to the platform.

- Anti-Fraud Organizations: Many countries have anti-fraud organizations or consumer protection agencies dedicated to combating scams and fraudulent activities. These organizations often have channels to report employment scams. Contact your local anti-fraud organization or consumer protection agency to file a complaint and provide them with all relevant information.

- Federal Trade Commission (FTC): In the United States, victims of employment scams can report the incident to the Federal Trade Commission (FTC). The FTC collects information on scams and uses it to investigate and take action against scammers. Visit the FTC’s website to file a complaint and provide detailed information about the scam.

- Seek Assistance and Guidance: If you have been a victim of an employment scam, there are resources available to help you deal with the aftermath. Contact your local consumer protection agency, seek legal advice, or reach out to organizations specializing in supporting scam victims. They can provide guidance, support, and resources to assist you in recovering from the scam and exploring possible legal recourse.

Remember to provide as much detail as possible when reporting an employment scam, including any emails, documents, or other evidence you may have. By reporting the scam, you contribute to raising awareness, assisting law enforcement in their investigations, and preventing others from falling victim to similar scams.

Educating Others: Spreading Awareness

- Share Personal Experiences: Encourage readers to share their own experiences with employment scams to raise awareness. Personal stories can be powerful in helping others understand the tactics used by scammers and the potential risks involved.

- Utilize Social Media: Social media platforms are effective tools for spreading awareness. Encourage readers to share informative posts, articles, and videos related to employment scams. Remind them to use hashtags related to job scams to reach a wider audience.

- Participate in Online Communities: Join online communities, forums, and discussion boards related to job searching or scam awareness. Engage in conversations, provide insights, and share cautionary tales to help others recognize and avoid employment scams.

- Organize Workshops and Webinars: Consider organizing workshops or webinars focused on educating individuals about employment scams. Invite guest speakers, such as law enforcement officials or cybersecurity experts, to share their knowledge and insights.

- Collaborate with Local Organizations: Partner with local community organizations, schools, and colleges to conduct awareness campaigns about employment scams. Offer to deliver presentations or host informational sessions to educate students, job seekers, and community members about the risks and prevention strategies.

- Create Educational Materials: Develop informative brochures, handouts, or infographics that outline the red flags and best practices for avoiding employment scams. Distribute these materials at job fairs, community centers, and other relevant venues.

- Use Online Platforms: Leverage online platforms such as blogs, websites, and newsletters to publish articles, guides, and tips on recognizing and avoiding employment scams. Encourage readers to share this information with their networks.

- Engage with Local Media: Reach out to local newspapers, radio stations, or television channels to raise awareness about employment scams. Offer to provide expert insights or share real-life stories to inform the public about the risks and protective measures.

By actively participating in spreading awareness, readers can play a vital role in protecting others from falling victim to employment scams. Remind them that education is key, and the more people are informed about the tactics used by scammers, the better equipped they are to protect themselves and their communities.

Staying Informed: Keeping Up with Employment Scam Trends

As job scams continue to evolve, it is crucial to stay informed about the latest trends and techniques used by scammers. By keeping up-to-date with the evolving landscape of employment fraud, individuals can better protect themselves and others from falling victim to these scams. Here are some ways to stay informed:

Follow News and Updates

Regularly read news articles, blogs, and reports related to employment scams. Stay informed about the latest scam tactics, emerging trends, and notable cases. This knowledge will help you recognize new variations of scams and stay one step ahead of scammers.

Subscribe to Fraud Alert Services

Sign up for fraud alert services provided by government agencies, consumer protection organizations, and cybersecurity companies. These services often send out timely notifications and updates about new employment scams and provide advice on how to avoid them.

Engage in Online Communities

Join online communities, forums, and social media groups that focus on job searching, career development, and scam awareness. Participate in discussions, share insights, and learn from the experiences of others. These communities can be valuable sources of information and can help you stay updated on the latest employment scam trends.

Follow Industry Experts

Follow experts and influencers in the fields of cybersecurity, employment, and fraud prevention on social media platforms. These individuals often share valuable insights, tips, and warnings related to employment scams. Their expertise can help you stay informed and make informed decisions during your job search.

Share Information

Actively share information about employment scams with your networks. By spreading awareness and sharing resources, you can help others stay informed and avoid falling victim to fraudulent job offers. Remember, collective knowledge is a powerful defense against scammers.

Pillar Support, a trusted resource in fraud awareness and prevention, offers comprehensive fraud awareness training. By joining our training program, you can gain valuable knowledge and insights into various types of scams, including employment scams. Take action today and equip yourself with the tools to recognize and avoid fraudulent job offers. Together, we can create a safer job-seeking environment for everyone.

Remember, staying informed is a continuous effort. By staying updated on the latest employment scam trends and sharing information within your networks, you can protect yourself and others from falling victim to fraudulent job offers. Stay vigilant, trust your instincts, and empower others to do the same.

Frequently Asked Questions

Are There Such Things as Job Scams?

Yes, job scams are unfortunately prevalent in today’s digital world. Scammers use various deceptive tactics to exploit job seekers, such as posting fake job openings, impersonating legitimate companies, or offering work-from-home opportunities that turn out to be fraudulent. It’s important to be cautious and vigilant during your job search to avoid falling victim to these scams.

Why Do People Fall for Job Scams?

Job scams can be convincing and prey on people’s hopes and financial needs. Scammers often use sophisticated techniques to create a sense of urgency or exploit individuals’ desires for better employment opportunities.

Additionally, scammers may appear professional, use official-sounding language, and provide seemingly legitimate documentation to deceive job seekers. It’s important to stay informed and be skeptical of any suspicious job offers or requests for personal or financial information.

What to Do If You Think a Company is Scamming You?

If you suspect that a company is involved in a scam or fraudulent activity, it’s important to take appropriate action. Here are some steps to consider:

Cease Communication: Stop all communication with the company or individual involved in the suspected scam. Avoid sharing any further personal or financial information.

Report the Scam: Report the incident to the appropriate authorities, such as your local law enforcement agency, the Federal Trade Commission (FTC), or the consumer protection agency in your country. Provide them with as much information as possible, including any correspondence or evidence related to the scam.

Contact Your Financial Institution: If you have shared your financial information with the scammer, immediately contact your bank or credit card company to report the situation and take the necessary steps to protect your accounts.

Seek Legal Advice: If you have suffered financial losses or believe you have been a victim of fraud, consult with a legal professional to understand your rights and explore any potential legal recourse.